Today, I wanted to speak about personal finances of a self-employed person – photographers, artists and freelancers in general. I started Visual Watermark as a part-time project while working with my ex-employer DevExpress Inc. It was fun and easy side-project since it yields small but steady revenue and didn’t require too much effort to support it. This year I left my day job to fully concentrate on my side-project.

This move gave me an opportunity to do what engages me a lot and still much more flexibility to spend time with my small baby. On another hand, it cut our revenues in half. I don’t have “extra” money anymore, money to buy a trip to the ocean without putting aside for a few months or money that I can put into business development if necessary. I still had enough to pay my expenses but no penny above that.

One day, I received an email from Google that my Adwords account was blocked because of insufficient funds on my card. I thought it was wrong, because I take all funds from my account for personal needs and left $300 on my business card to pay for the ads. Google never charged me more than that before and I expect these funds to be enough to pay the bill.

The bill was $302.94. Only $2.94 is missing! This is evening and Friday, there is nobody in the bank, nobody will take some cash from me to add to the account. What’s the heck! Google will stop showing my ads and I will loose several hundreds during this weekends.

Fortunately, Adwords doesn’t stop showing ads immediately – it tries to charge the card the other day. Only when it fails several times, it blocks the ads. Hopefully, I was saved. Unfortunately, similar cases happened several times after that.

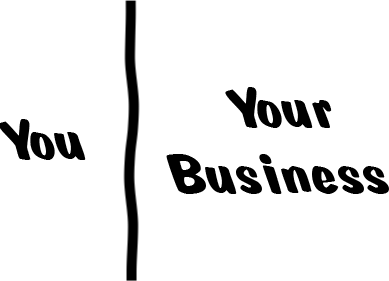

I’ve learned from this case that you should separate business and your own wallets. Your business isn’t you and you have to draw a line between your finances and business finances.

Your business “hires” you and pays you a salary to make living. It sounds weird for a freelancer photographer who is an employee and employer at the same time or a self-employed person in general but you should think about you as about an employee you’ve hired.

You have to pay a salary to the employee (you), pay business expenses and taxes. If there is still something left means you make profit. If there are not enough funds to pay the bills you make loses, you need to borrow some cash to pay the bills or taxes. If you use your personal funds to pay your business debts, you will lower your life quality – you will have to buy worse food, use a car or go out less frequently. If you take your business funds for your personal needs, you slow down your business. You may use this money to buy advertising to find new clients, or buy new equipment to make better shots, or repair your studio. Without separation of your personal and business incomes you won’t be able to build a sustainable and profitable business.

You should figure out how much you need to support your current life style and make it your “salary”. Figure out your expenses – transportation, advertising, equipment rent and everything else. Even paper you use to print invoices has to be included to your expenses. Now subtract both these numbers from your revenues. If the result is more than zero, you make profit; if it’s less than zero – I’m sorry – you loose money every month. If you loose money, you should cut your expenses or increase pricing.

Visual Watermark

Visual Watermark

by

by